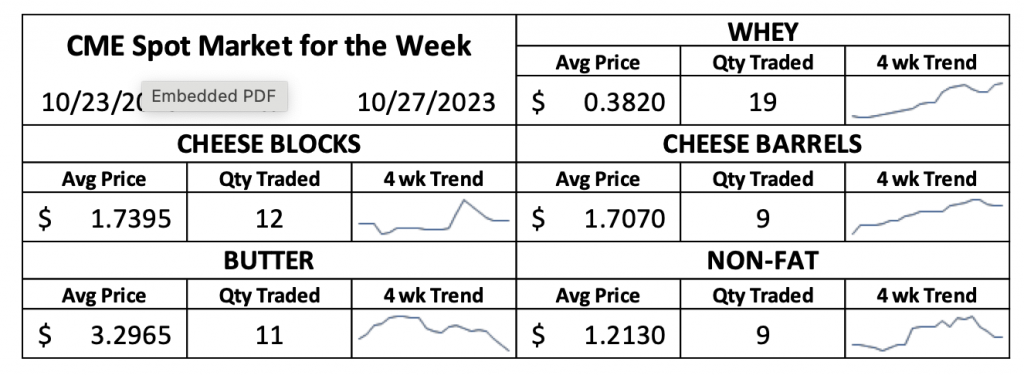

It remains uncertain whether the Pulse auction serves as a reliable indicator for global SMP values, given its recent inception and limited participation. Nevertheless, it has raised apprehensions about the overall demand for milk powder worldwide. In parallel, CME spot nonfat dry milk experienced a 3.5ȼ decrease this week, reaching $1.1975 per pound.

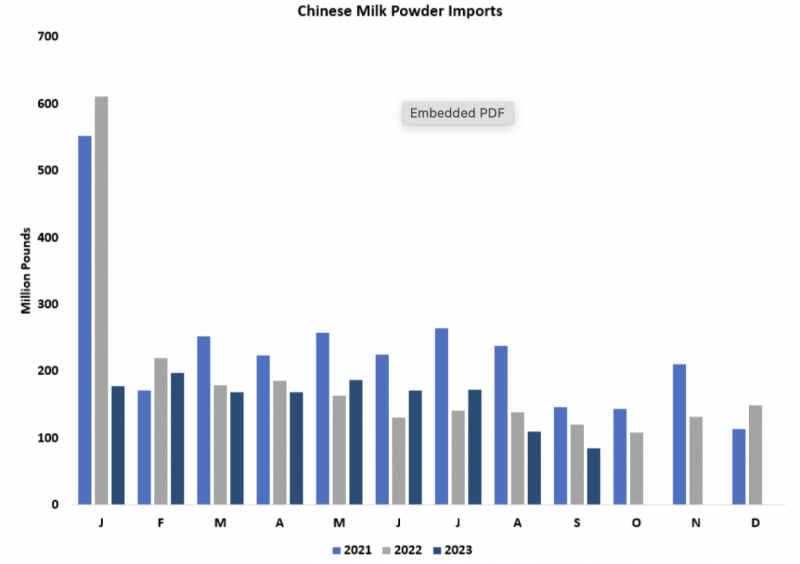

China’s dairy import data echoed the unsettling sentiment, with WMP imports hitting a five-year low at less than 42 million pounds in September. SMP imports from China also recorded a five-year low at 43 million pounds, resulting in a 29.5% decrease compared to the previous year. While these figures are discouraging, they align with expectations, considering the product was procured during a period when China was less active in the global market. Despite possessing substantial milk powder stocks, there is potential for improved foreign product demand from China in the future.

On a more positive note, China exhibited increased imports of butter and cheese, surpassing volumes from the previous year. Whey imports experienced an 11.6% decline, but U.S. whey imports to China saw a notable increase from the low volumes observed between February and August.

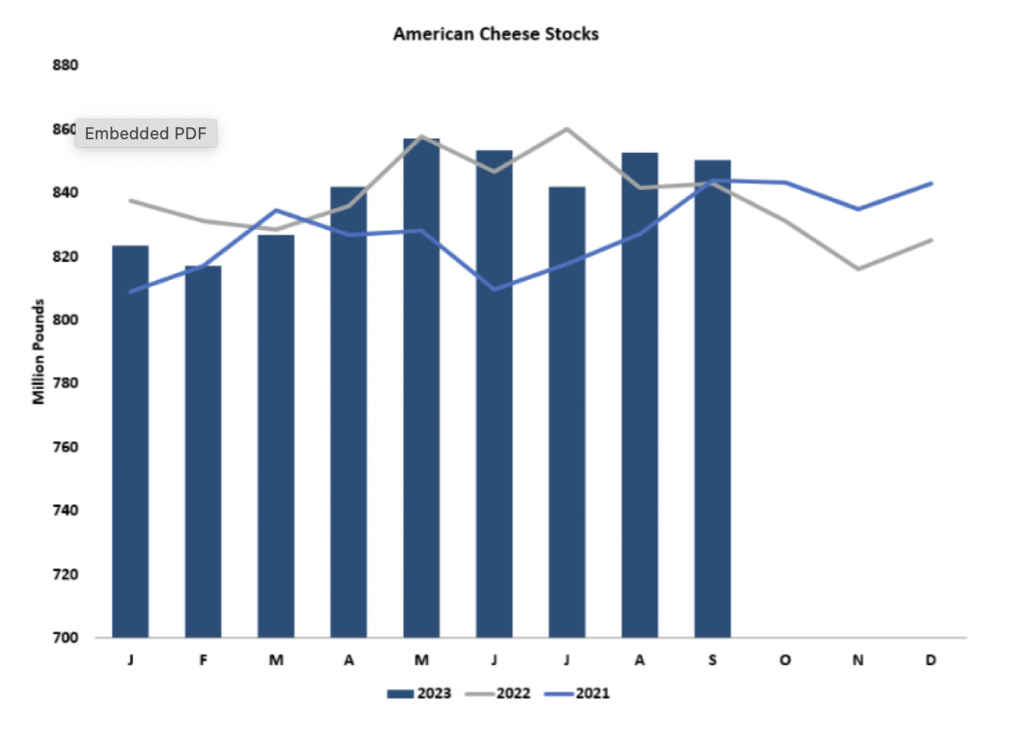

Domestically, demand indicators were mixed. The USDA’s Cold Storage report indicated a decline of 23 million pounds in cheese stocks from August to September. Although the month-to-month decrease was stronger than usual, it may be attributed to a rebound from slow sales in August rather than an extraordinary surge in demand. Inventories of American-style cheeses, including Cheddar, remained relatively stable. CME spot Cheddar blocks fell 5.75ȼ to $1.73, while barrels slipped 2.75ȼ to $1.6825.

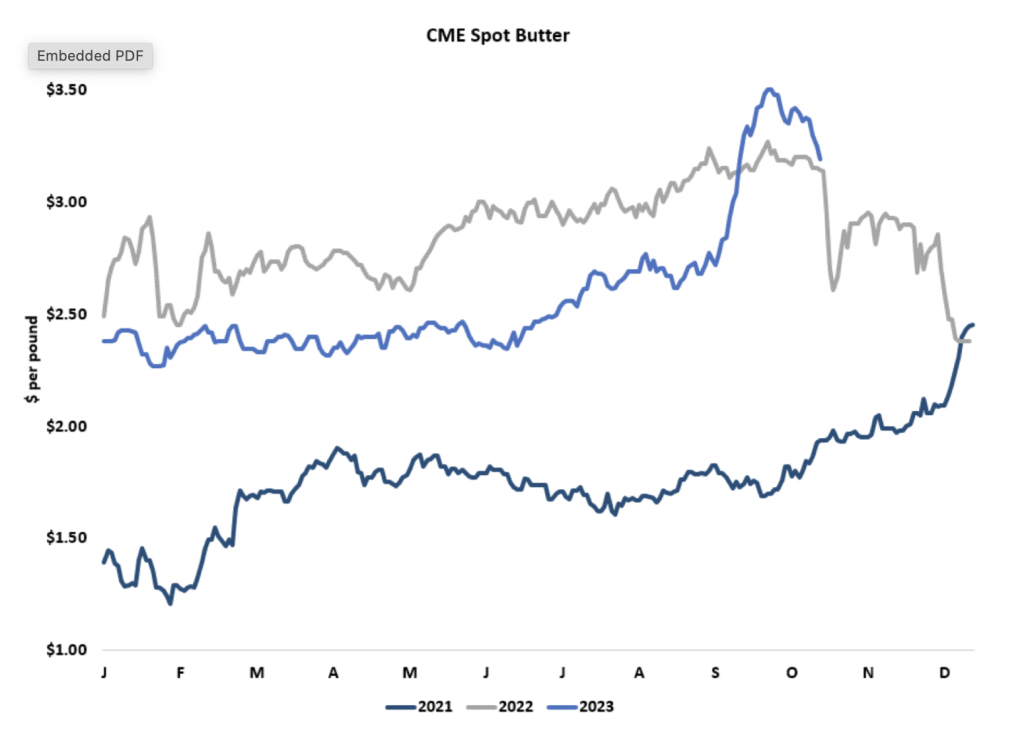

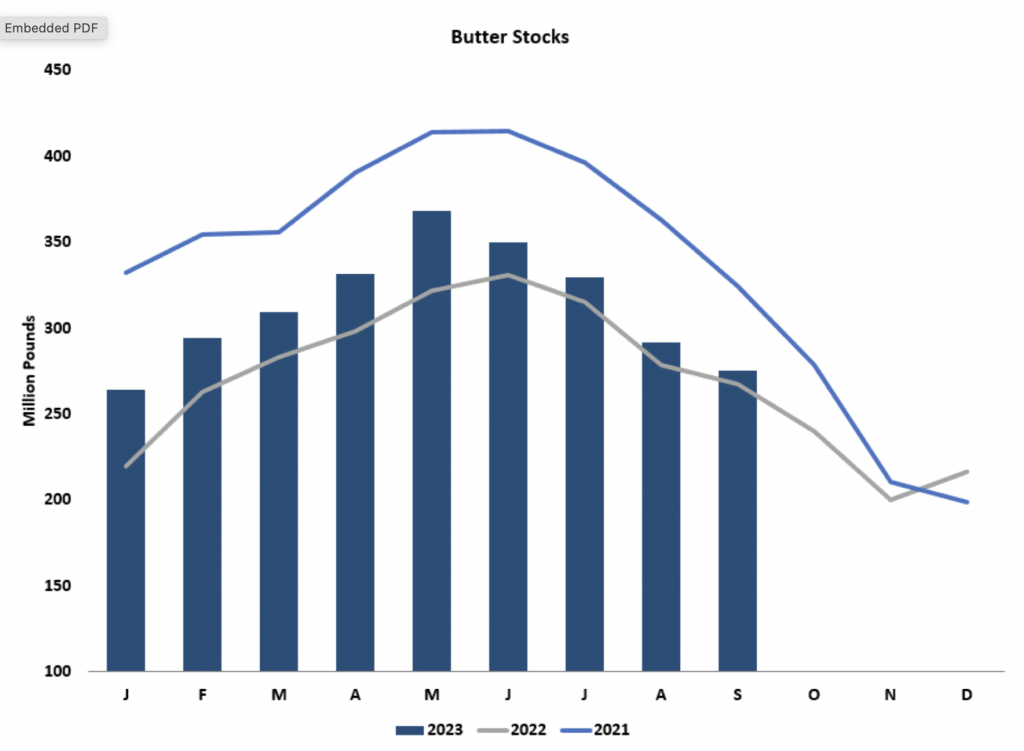

Butter stocks decreased by 16.3 million pounds from August to September, totaling 275.4 million pounds. While the decline slowed in September due to surging prices deterring buyers, inventories remained 3% higher than in September 2022. CME spot butter prices dropped significantly, plummeting 16.75ȼ to $3.1925 per pound. As grocers and buyers conclude stocking for the holiday baking season, further price decreases are anticipated.

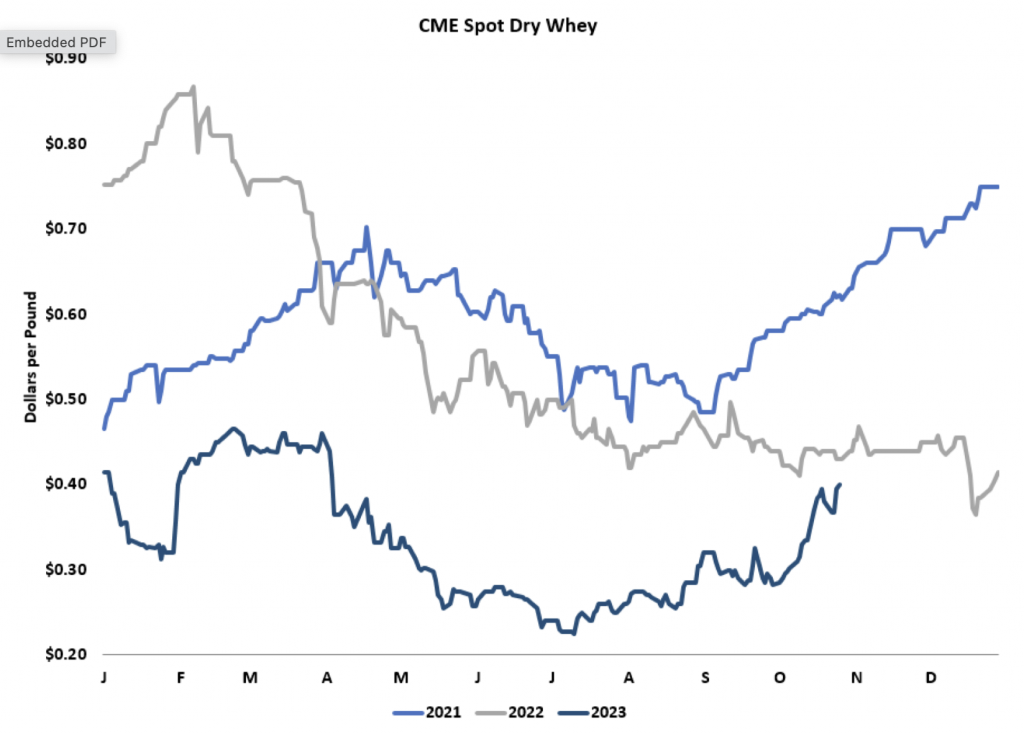

In contrast, the whey market experienced a positive trend, with CME spot whey powder climbing half a cent to 40ȼ, reaching levels not seen since April. Stronger Chinese imports of U.S. whey likely contributed, but the primary driver was a substantial increase in domestic demand for high-protein whey concentrates.

Amidst the challenges faced by most dairy products, both Class III and Class IV futures witnessed notable setbacks. November and December Class III futures lost 72ȼ and 80ȼ, respectively, forecasting mid-$17s for milk into early next year. Class IV contracts also saw significant declines, with the October contract settling at $21.60, November a dollar lower, and December at $19.49.

As the harvest season unfolds and grain prices decline, December corn settled at $4.8075 per bushel, down more than 15ȼ for the week. The ample supply of corn on the U.S. balance sheet is expected to meet domestic demand, keeping prices relatively low. However, concerns about a potential decline in South American crop prospects could lead to a spike in grain values and boost U.S. corn and soybean exports. The current forecast, with showers expected in the driest parts of northern Brazil and Argentina, has temporarily alleviated these concerns. Nonetheless, challenges such as a strengthened dollar and logistical complications have impacted U.S. corn and soy export prospects.according to the reports published in dairynews.today .

Despite these challenges, the USDA reported a series of new corn and soybean export sales, with soybean meal leaving the U.S. at a record-setting pace. The surge in demand for soybean meal, coupled with reduced Argentine soybean crop yields, led to a price increase, with December soybean meal reaching $442.40 per ton, up $18.50 from the previous Friday.

![Poolani Milk Cooperative Society [PMCS] well-established and fastest-growing in the Dairy Sectorof RuralKerala](http://thedairytimes.com/wp-content/uploads/2024/04/1-218x150.jpg)

![Poolani Milk Cooperative Society [PMCS] well-established and fastest-growing in the Dairy Sectorof RuralKerala](http://thedairytimes.com/wp-content/uploads/2024/04/1-100x70.jpg)