New Delhi, July 08, 2024: With many states enacting stringent anti-slaughter laws, Indian dairy farmers have been facing challenges in disposing of unproductive cattle — the ones that do not give enough milk or happen to be male.

Now, they have been hit by a new “surplus” problem — of skimmed milk powder (SMP). Cooperative and private dairies are holding an estimated 3-3.25 lakh tonnes (lt) of SMP stocks at the start of the production year that runs from July to June.

Here is why there is a surplus in SMP stocks, why that matters, and what can be a possible solution.

Cow milk contains 3.5% fat and 8.5% solids-not-fat (SNF) on an average, with the same at 6.5% and 9% for buffalo milk. Being perishable, milk cannot be stocked. Only its solids (i.e. fat and SNF) are storable after separation of the cream and drying of the skimmed milk.

During the “flush” season, when cattle and buffaloes produce more, dairies convert the surplus milk they receive into butter, ghee and SMP — the first two from cream/fat, and the last from SNF. These solids are recombined along with water into liquid milk during the “lean” season, when production by animals falls and may not suffice to meet demand.

The flush season in the South and Maharashtra (states with predominantly cow populations) generally extends from July, post the southwest monsoon rains, till December. In the North and Gujarat, it extends from September to March (coinciding with the calvings of buffaloes, which outnumber cows in this belt).

From every 100 litres (or 103 kg) of cow milk, a dairy can make about 8.75 kg of SMP (at 8.5% SNF), and 3.6 kg of ghee (at 3.5% fat).

So, what’s this problem of surplus in SMP?

The problem arises when dairies procure excess milk — beyond the normal surplus during flush — and the SMP and butter/ghee produced do not have many takers.

Dairies in India produce 5.5-6 lt of SMP annually. A big chunk of that, roughly 4 lt, is used for recombining during the lean season. The balance 1.5-2 lt gets consumed by makers of ice cream, biscuits, chocolate, sweetmeats, baby formula, and other food and industrial products.

2023-24 was a year of abundant and continuous milk supplies with hardly any lean period. It was in marked contrast to 2022-23 that saw unprecedented shortages. Dairies in Maharashtra realised record prices of Rs 430-435 per kg for yellow (cow) butter, and Rs 315-320 for SMP during February-March 2023. They also paid farmers Rs 37-38 a litre for cow milk with 3.5% fat and 8.5% SNF, encouraging them to ramp up production, through better feeding and induction of new animals.

The resultant augmented milk availability, including in the peak lean summer months of April-June, meant that hardly 2.5 lt of SMP was consumed for reconstitution purposes. Instead of the normal July-opening stocks of 1.5-1.75 lt, dairies are now saddled with 3-3.25 lt of SMP. With the new flush season taking off — and expected to peak after September, when more milk would flow from the udders of buffaloes too — the problem of surplus may worsen.

What’s been the impact of the surplus so far?

Cow SMP realisations for dairies have crashed to Rs 200-210 per kg, and to Rs 335-340 for yellow butter. The latter corresponds to a ghee price of Rs 408-415 per kg (ghee has close to 100% fat, as against 82% for butter).

The surplus problem is, however, less in milk fat, as its annual production by dairies is only 3-3.5 lt. Fat, unlike SMP, also has a good market in India, both among households and industrial consumers. This is more so during the grand festival months from August to November, when consumption of mithais goes up. The base ingredients — ghee, khoa, chenna and paneer — in most indigenous sweets come from high-fat milk. There’s a higher chance, then, of fat prices recovering than that of SMP.

At current per-kg realisations, the gross revenue for a dairy producing 8.75 kg of SMP and 3.6 kg of fat/ghee from 100 litres of cow milk would be Rs 3,224-3,333. Deducting Rs 350 post-procurement expenses (on chilling, aggregator/collection agent commission and transport to the plant), and Rs 350 processing and packing costs, the dairy can, at most, pay farmers Rs 2,524-2,633, or Rs 25.24-26.33 per litre. And that’s more or less what they are paying according to the reports published in indianexpress.com.

Politically, this could be a disaster — particularly ahead of the Maharashtra state assembly elections due in October. The National Democratic Alliance government there, on June 28, announced a Rs 5/litre subsidy payable to farmers on the milk they supply to dairies. The scheme’s fine print though — eligibility criteria and coverage of farmers as well as dairies — is still awaited. Even if implemented well in time for the polls, it wouldn’t address the underlying problem of SMP stock pile-up.

Ganesan Palaniappan, a dairy ingredients trader in Chennai, believes that the only way to get rid of the excess SMP stocks is exporting it out, whether commercially or as commodity assistance to neighbouring countries.

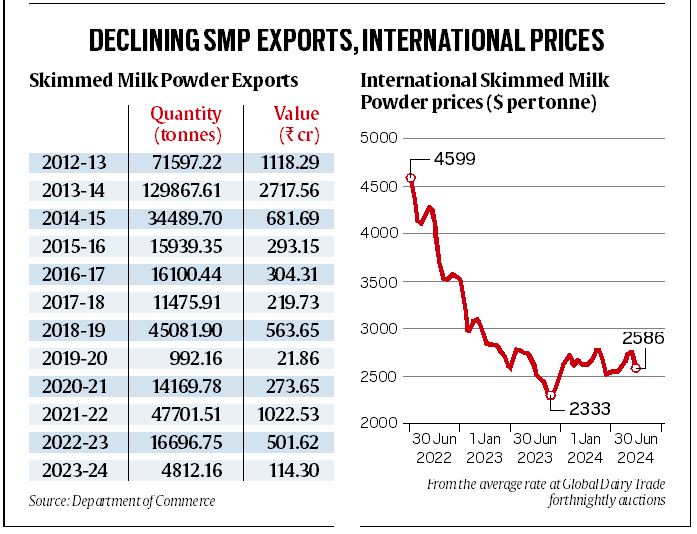

But the drop in global prices — SMP rates at the New Zealand-based Global Dairy Trade fortnightly online auction platform are ruling at $2,586 per tonne, down from the recent high of $4,599 in April 2022 — makes commercial exports unviable. India’s SMP shipments have, moreover, been on the decline, from 1.3 lt in 2013-14 to 4,800 tonnes in 2023-24 (see chart and table).

“The Centre should give a subsidy on SMP exports, which will boost domestic prices and enable our dairies to pay more to farmers,” said Palaniappan.

R S Sodhi, president of the Indian Dairy Association, suggested that the Centre create a 50,000-100,000 tonne buffer stock of SMP: “If farmers don’t get remunerative prices, they will not feed their animals properly, and you would have milk inflation next year. A buffer stock (the government buying powder from dairies and also paying for its storage) will support prices for producers now and protect consumers from future inflation”.

The reasons are two-fold. First, there is growing demand for milk fat in India. But for every 1 kg of fat, dairies also end up making over 2.4 kg SMP. Secondly, farmers prefer rearing cows, as they — notwithstanding issues relating to disposal of unproductive cattle — yield more milk and start calving earlier than buffaloes. At the same time, 1 kg of fat from buffalo milk results in production of less than 1.4 kg of SMP.